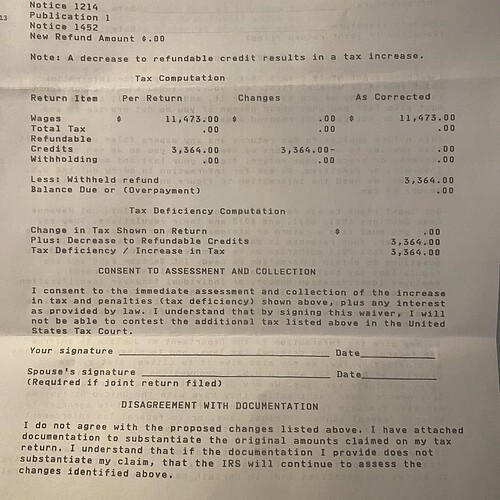

If I agree to the changes the IRS is making, does that mean I have to pay them $3,364?

The IRS is saying they want to reduce the refundable credits you claimed on your tax return.

Can you check your online IRS account transcript for that tax year?

@Feng

Yeah, I checked. It shows I have a $3,364 credit on my account, but I only got $522 in my refund. Does this mean I owe them money, or will they just reduce my credits to zero?

Ming said:

@Feng

Yeah, I checked. It shows I have a $3,364 credit on my account, but I only got $522 in my refund. Does this mean I owe them money, or will they just reduce my credits to zero?

If they take away that credit, you won’t get anything extra back, but you also shouldn’t owe anything more. The letter doesn’t seem to say they’re increasing your tax bill, just that they’re removing the credit.

What credit did you claim? Also, was the $522 taken from your W-2? Was that all your income? Were you expecting to get a $3,886 refund?

They’re just saying they’re taking away the $3,364 in refundable credits. That would make everything even.

Did you claim a child on your tax return that wasn’t actually related to you? It looks like the $522 you got was from the Earned Income Credit (EIC) for yourself, and they might be rejecting your claim for a child.

@Zinnia

Was this notice sent before they issued any refund?

Cedar said:

@Zinnia

Was this notice sent before they issued any refund?

I think it started as a CP75 or CP75A notice for an EIC audit. You likely qualified for about $522 in EIC by yourself, but they held the rest until you provided proof that you could claim a child. Sounds like that proof never got submitted.

The numbers aren’t exact, but they’re close.

@Zinnia

So if they don’t agree, is there anything they can do to change this?

Cedar said:

@Zinnia

So if they don’t agree, is there anything they can do to change this?

Not really, unless they never got a chance to respond to the original notice. But they haven’t mentioned anything about that.

Cedar said:

@Zinnia

Was this notice sent before they issued any refund?

The letter says they held back part of the refund. Probably waiting for proof of eligibility.

Yes, you will owe if the IRS is right.

Your tax return says you qualified for $3,364 in credits. The IRS says you didn’t. Someone made a mistake—either you or them.

Bailey said:

Yes, you will owe if the IRS is right.

Your tax return says you qualified for $3,364 in credits. The IRS says you didn’t. Someone made a mistake—either you or them.

Can’t they just remove the credits? I only got $522, so I shouldn’t owe them anything, right?

@Ming

No, because it was a refundable credit. Without it, you would have owed $3,364 minus the $522 they already gave you.

What credit was it, and why do they say you don’t qualify?

Yeah, you’ll owe.

Not agreeing won’t change that. You didn’t have $3,364 withheld from an $11,000 income.

Expect penalties and interest, too.

Cedar said:

Yeah, you’ll owe.

Not agreeing won’t change that. You didn’t have $3,364 withheld from an $11,000 income.

Expect penalties and interest, too.

It’s a refundable credit, not withholding. Withholding is listed separately.

@Vinnie

Oh, my mistake.

@Vinnie

Can’t they just wipe out the credit instead of making me owe money? I only got $522 back. Why would I owe $3,364?

Ming said:

@Vinnie

Can’t they just wipe out the credit instead of making me owe money? I only got $522 back. Why would I owe $3,364?

You probably used $2,842 of that credit to reduce your tax bill to zero. Now that they’re removing the entire $3,364, your tax liability comes back, meaning you owe that $2,842 plus the $522 they already gave you.

No one’s really mentioned what credit got denied or why. Do you agree with the IRS, or do you think they’re wrong?

Cedar said:

Yeah, you’ll owe.

Not agreeing won’t change that. You didn’t have $3,364 withheld from an $11,000 income.

Expect penalties and interest, too.